The trading opportunities in Argentina are large and lucrative. The distinct geographical landscapes and range of strong national sectors provide companies with a varied range of potential business ventures. There are many rapidly expanding sectors to both import and export in Argentina. Hence why forming a company in Argentina is becoming increasingly popular.

The current trading environment for import and export in Argentina has been made a lot easier with the government’s decision to encourage Foreign Direct Investment (FDI). The government does not see a difference between foreign investors and domestic investors – ie. they are treated as equals when investing. There are also several investment incentives and trade benefits to encourage greater FDI.

Biz Latin Hub can help you both import and export in Argentina. Our full array of back office services is designed to offer you full support, from company formation through day-to-day accounting, legal support and payroll up until eventual termination if necessary. With 18 dedicated offices across the region we can also do the same anywhere in Latin America and the Caribbean.

Import and export in Argentina – international trade

Argentina’s main imports include vehicles, machinery, electrical machinery and equipment, petroleum and natural gas, organic chemicals and plastics. Argentina’s top four import partners are Brazil, China, the EU, and the US. Argentina’s main exports include animal feed, cereals, motor vehicles and parts, petroleum and gas, and soybeans. Argentina’s top four export partners are Brazil, the EU, the US, and China.

Not only is there an abundance of trade opportunities in Argentina but there are also numerous benefits for businesses.

Why import and export in Argentina?

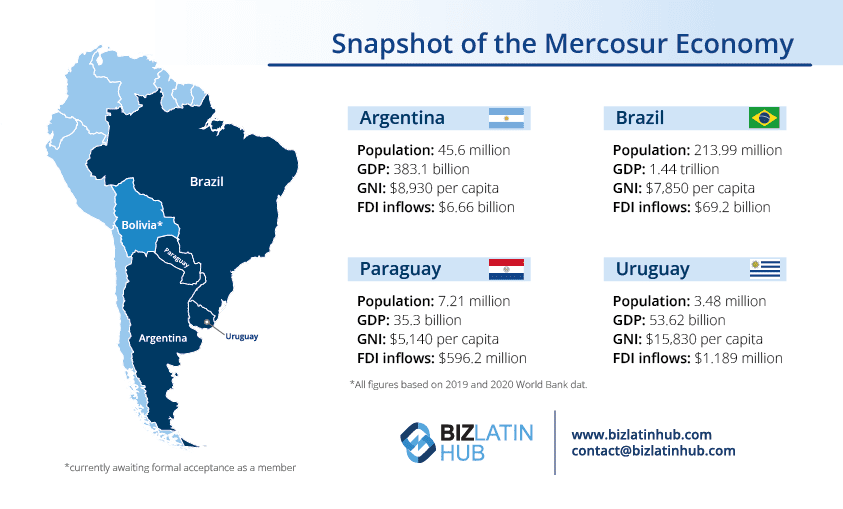

Firstly, Argentina is one of the founding members of the Association for Latin American Integration (ALADI). This association is working towards establishing a common market in Latin America. Secondly, there is the key membership of MERCOSUR.

This South American trade bloc, with Argentina, Brazil, Paraguay, and Uruguay (Venezuela is temporarily suspended), gives traders great freedom to import and export with the other member countries through certain tax exemptions and non-tariff trade barriers. In addition, EU-MERCOSUR negotiations are currently underway to try to reach a trade agreement between MERCOSUR and the European Union (EU). Below is a list of more benefits of trading in Argentina:

Free Trade Zones (FTZs): There are several FTZs in Argentina but the main zones include La Plata, Tierra del Fuego, and General Pico La Pampa. This means that companies trading within these zones are tax-exempt and do not have to deal with tariffs. They are zones outside the “general customs area”. Foreign companies are treated the same as domestic companies.

Special Customs Area (SCA): Investing in Tierra del Fuego means reaping the benefits of it being an SCA. Companies trading within this tax exemption area can enjoy the benefits it gives up until 2023 when this benefit is set to expire.

Smaller Enterprises: The National Fund for the Development of Micro, Small and Medium Enterprises gives these sized enterprises lower cost credits for investment in certain projects.

Exportation: Goods and services to be exported are exempt from excise taxes and VAT (although some merchandise is subject to export duties).

Mining: There are specific industries that have unique investment incentives and one such is mining. Under the mining investment law, companies involved in mining ventures are able to enjoy fiscal stability meaning they will experience the same tax rate for 30 years (excluding VAT which will adjust accordingly).

In order to import and export legally in Argentina, there are some key requirements that must be fulfilled. Companies must comply with the necessary legislation enacted by the Argentine Tax and Customs Authority (AFIP).

Legal process and requirements – Argentine importation and exportation

Importation Requirements:

Companies established in Argentina first have to have approval from the Argentine Tax and Customs Authority (AFIP) and they then need to be registered in the National Registry of Importers and Exporters. You do not have to pay to register and the registration process is not particularly complex.

- License to import is required (submit information through the Sistema Integral de Monitoreo de Importaciones (SIMI))

- Certificate of Origin – the unit of origin verifies and certifies the origin of goods

- Packing list – necessary for customs clearance in Argentina. This describes the contents of the packages to be imported

- Bill of lading (for maritime shipments) or Airway bill (for air cargo shipments)

- Commercial invoices – must comply with the standards set by AFIP and must be in Spanish (one original and three copies).

Importation tariffs in Argentina:

When you import any goods or products, companies must pay tariffs to the Dirección General de Aduanas. The MERCOSUR Common Nomenclature (Nomenclatura Común del MERCOSUR (NCM)) is the tariff classification that Argentina uses. The Common External Tariff (CET) ranges from 0% to 20% but certain products such as those in the automotive sector can reach 35%. The average rate that is applied to all imported goods as a whole is 12.6%. For agricultural goods, it is a rate of 10.3% and for manufactured goods, it is 13.0%.

In addition to the importation tariff used, companies importing will also have to pay other fees including VAT of 10.5% or for Cost, Insurance and Freight (CIF) 21%. The tariffs on imports are also based on the declared CIF value.

Do bear in mind that excise taxes are also applied to certain goods.

Exportation requirements:

Companies established in Argentina need to be registered in the National Registry of Importers and Exporters.

- Presentation – of any relevant exportation documents, permits, and licenses to commercialize the product(s) to be exported.

- Shipping permit – the destination of the goods or services to be exported must be stated in a destination application

- Certificate of Origin – the unit of origin verifies and certifies the origin of goods

- Health certificates – if they are required (product dependent)

- Packing list – necessary for customs clearance in Argentina. This describes the contents of the packages to be exported

- Bill of lading (for maritime shipments) or Airway bill (for air cargo shipments)

- Commercial invoices – must comply with the standards set by AFIP and must be in Spanish (one original and three copies).

FAQs on how to import and export in Argentina

Yes, Argentinian companies can be 100% foreign-owned.

Companies established in Argentina first have to have approval from the Argentine Tax and Customs Authority (AFIP) and they then need to be registered in the National Registry of Importers and Exporters. You do not have to pay to register and the registration process is not particularly complex.

For importation, the following are generally necessary:

License to import is required (submit information through the Sistema Integral de Monitoreo de Importaciones (SIMI))

Certificate of Origin – the unit of origin verifies and certifies the origin of goods

Packing list – necessary for customs clearance in Argentina. This describes the contents of the packages to be imported

Bill of lading (for maritime shipments) or Airway bill (for air cargo shipments)

Commercial invoices – must comply with the standards set by AFIP and must be in Spanish (one original and three copies).

For exportation, the following:

Presentation – of any relevant exportation documents, permits, and licenses to commercialize the product(s) to be exported.

Shipping permit – the destination of the goods or services to be exported must be stated in a destination application

Certificate of Origin – the unit of origin verifies and certifies the origin of goods

Health certificates – if they are required (product dependent)

Packing list – necessary for customs clearance in Argentina. This describes the contents of the packages to be exported

Bill of lading (for maritime shipments) or Airway bill (for air cargo shipments)

Commercial invoices – must comply with the standards set by AFIP and must be in Spanish (one original and three copies).

Incoterms are developed and regulated by the International Chamber of Commerce (ICC). With 3 distinct letters, the ICC uses incoterms to define the responsibilities and obligations of the exporter and importer. It takes into account, in particular, loading and transport information, type of transportation used, insurance, risks, and place of delivery.

There are specific industries that have unique investment incentives and one such is mining. Under the mining investment law, companies involved in mining ventures are able to enjoy fiscal stability meaning they will experience the same tax rate for 30 years (excluding VAT which will adjust accordingly).

Biz Latin Hub can help you import and export in Argentina

Argentina is a country with plenty of trading opportunities for international companies and foreign investors. The government has created a more attractive business environment to encourage investments and to facilitate easier trade between neighboring countries and also worldwide.

Biz Latin Hub can provide you with a professional and personalized service, providing tailored support with the legal processes involved in order to import and export in Argentina.

Reach out to the our bilingual team of Biz Latin Hub Argentina and see how we can support your business.